Identify & Correct Overpaid Direct Assessments.

Maximize Your NOI.

SurTax analyzes complex non-ad valorem tax charges (Direct/Special Assessments like sanitation, sewer, CFDs) for commercial properties in LA & Orange County, identifying overcharges using exclusive data analysis and expertise. Risk-free, contingency-based review.

Proprietary Data Engine

Unmatched analysis powered by our database of 400M+ historical LA & Orange County non-ad valorem assessment and refund records since 2001.

Singular Focus & Expertise

Deep specialization solely on complex, often overlooked non-ad valorem taxes – sanitation, sewer, lighting, CFDs – navigating varied jurisdictional rules.

Performance-Based Analysis

Zero upfront cost for our analysis. Our incentives are aligned with yours; we succeed only when potential overcharges leading to refunds are identified.

Illuminating Hidden Tax Overcharges

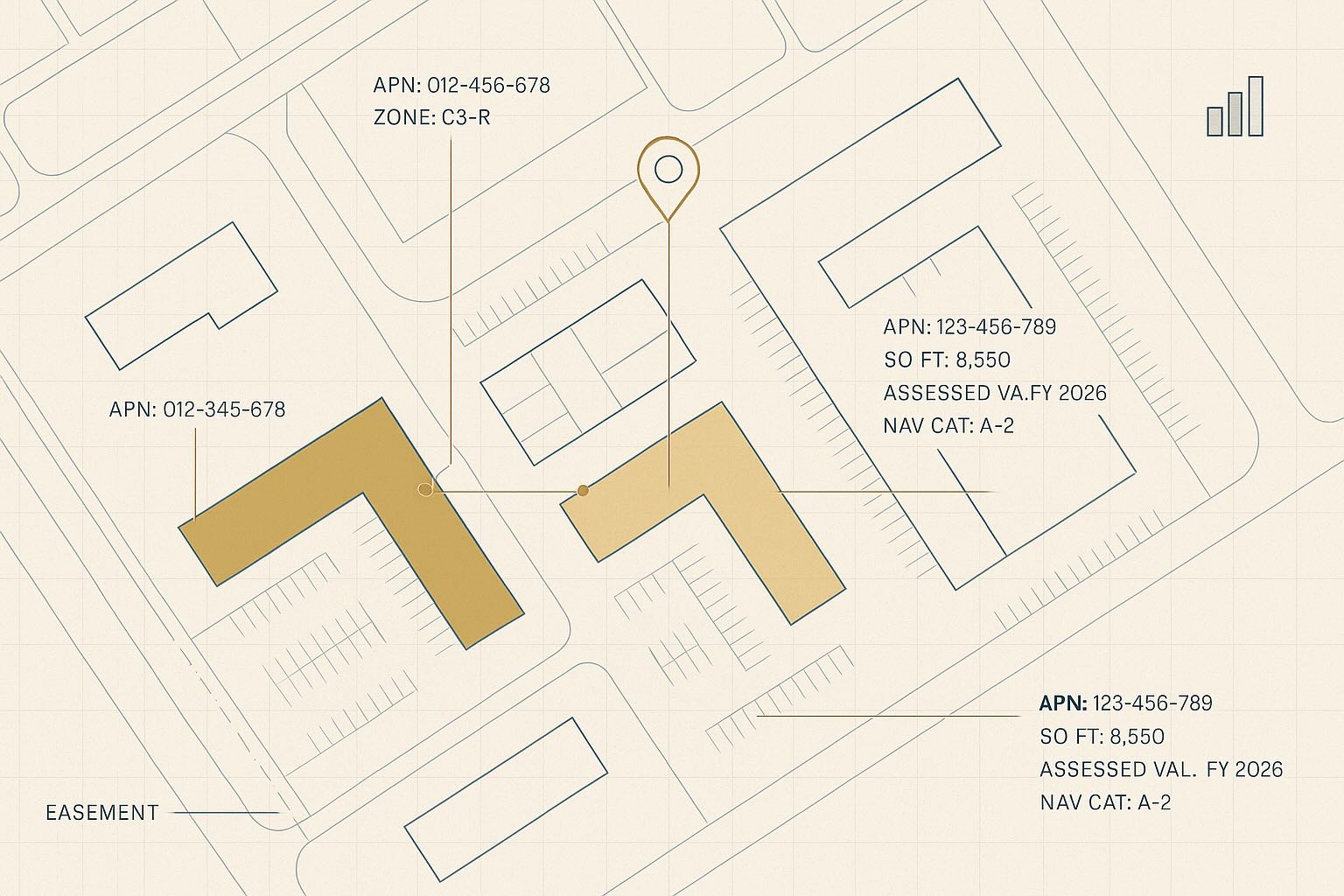

Beyond the standard ad valorem property tax, commercial tax bills in Los Angeles and Orange County contain numerous non-ad valorem assessments (Direct/Special Assessments). These charges fund specific services but are prone to errors from outdated data, misapplied formulas, shifting regulations, or inconsistent terminology across jurisdictions.

SurTax LLC provides clarity through expert analysis. We utilize a rigorous, data-centric methodology combining deep institutional knowledge of local tax codes with analysis of assessment practices and refund data since 2001. Our proprietary platform benchmarks charges and identifies discrepancies invisible in standard reviews.

We act as your trusted analytical partner, meticulously identifying potential overpayments and providing the data needed to pursue corrections, ultimately enhancing your bottom line.

Our Streamlined Analysis Process

- Submit Property Info: Use our assessment tool or contact form with basic property details.

- Free Initial Analysis: We cross-reference your property against our historical NAV assessment & refund database.

- Contingency Agreement: If analysis indicates potential savings, we proceed with our no-risk agreement for a detailed audit.

- In-Depth Data Audit: We gather necessary documents (tax bills, often LOA for usage data) and perform detailed analysis.

- Findings & Claim Support: We provide you with substantiated findings required for filing claims with relevant agencies.

- Results Verified: You confirm refund receipt. We invoice our success-based fee based on identified & recovered funds.

The SurTax Data Edge

Our ability to consistently identify significant overcharge potential stems from our unique data advantage, specific to Los Angeles & Orange County Non-Ad Valorem assessments:

- Comprehensive historical charge data analysis (NAV specific) since 2001.

- Analysis of granular refund records and success benchmarks.

- Tracking of evolving assessment methodologies & regulations.

- Detailed property usage and classification analytics.

This intelligence enables precise benchmarking and the identification of systemic errors invisible through standard property tax reviews.

Serving Diverse Commercial Portfolios

Property Owners & Investors

Directly enhance asset value and NOI through identified OpEx reductions.

Asset & Property Managers

Reduce operating expenses and demonstrate fiduciary value.

CRE Brokers & Advisors

Provide distinct client value-add focused on specialized tax charges.

Corporate Finance & Tax Teams

Ensure NAV assessment accuracy, mitigate risk, optimize P&L.

REITs & Institutions

Achieve portfolio-level savings via systematic NAV analysis.

NNN Leaseholders

Verify validity of complex pass-through NAV tax charges.

Common Questions

What specific taxes do you analyze?

We focus exclusively on non-ad valorem assessments (often called Direct or Special Assessments) on LA & Orange County property tax bills. Examples include charges for Sanitation Districts (LACSD, OCSD), sewer maintenance, street lighting, landscaping (L&L), Mello-Roos (CFDs), and other levies tied to specific services or benefits, not property value.

How is your analysis different?

Our advantage lies in:

- Singular Focus: Deep expertise solely focused on complex NAV assessments often overlooked by generalists.

- Proprietary Data Analysis: We analyze over 400M historical NAV assessment records and related refund information for LA/OC going back to 2001. This allows us to benchmark charges, identify calculation errors, and spot anomalies missed in standard property tax reviews.

Is your service confidential?

Absolutely. Client confidentiality is paramount. All property information, tax data, and analysis findings are handled under strict confidentiality agreements and secure data practices. We act solely on your behalf.

What information do you need to start?

Initially, just the property address or APN for the free eligibility check. To perform a full, detailed analysis, we typically require a signed contingency agreement and copies of relevant property tax bills for the years under review.

What is your fee structure?

We operate purely on a contingency basis. There are no upfront fees for our analysis. We only earn a pre-agreed percentage of the actual refund amount successfully secured by the client based on our findings. If no refund is obtained, you owe us nothing.

Does this conflict with Prop 13 / assessed value appeals?

No. Our work is entirely separate and complementary. Standard property tax appeals challenge the assessed value (ad valorem tax) handled by the County Assessor. We analyze the separate non-ad valorem charges levied by different agencies (Sanitation, City Services, etc.). Identifying errors in these service-based fees does not trigger a property value reassessment under Prop 13.

Initiate Your Confidential Review

Contact us to discuss your property portfolio and begin the no-risk process of identifying potential non-ad valorem tax overcharges.